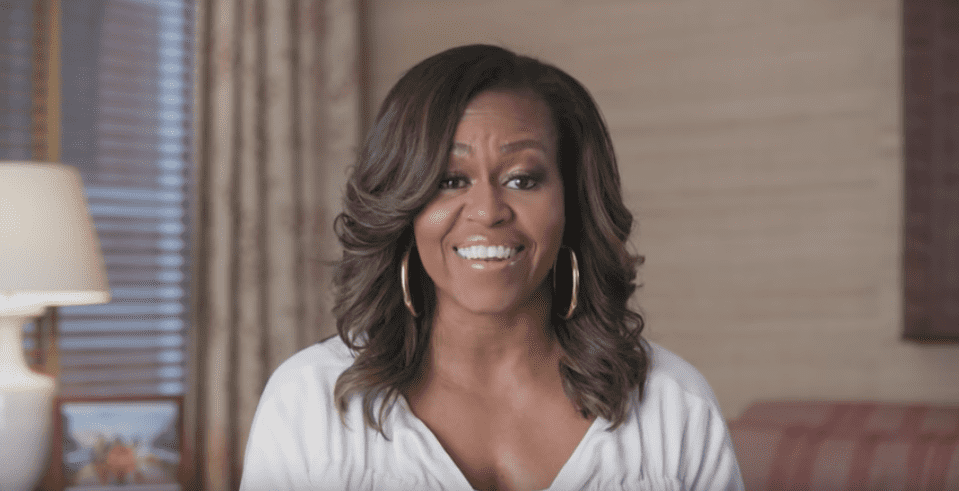

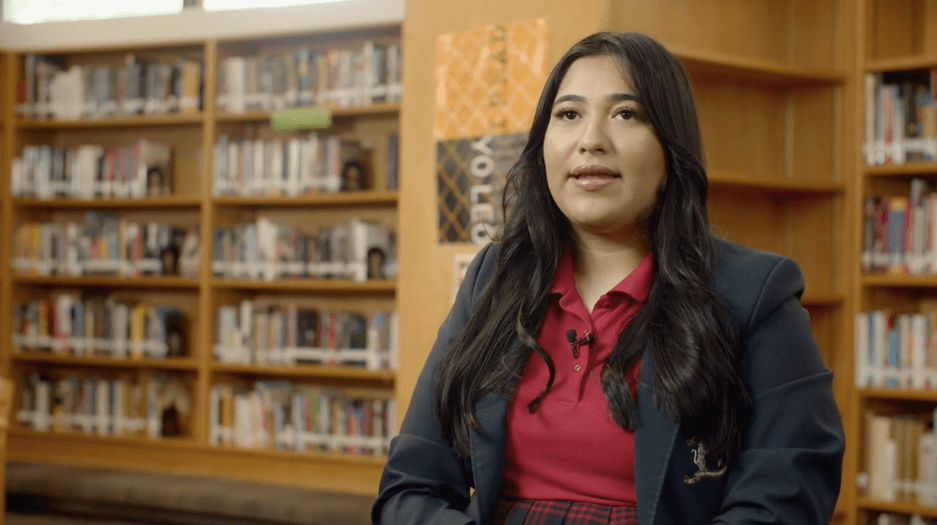

Invest in your future

We know it can seem overwhelming, but you’re not the first to question if you’ll find the right college, succeed and get the career you want. You might even be wondering if college is worth it. At least that one’s easy: The answer is always “yes.”