Financial planning for college

The federal government

From federal grants and student loans to employment through the federal work-study program, the U.S. Department of Education awards about $150 billion a year to more than 15 million students. Visit the Office of Federal Student Aid to learn more.

Your state government

Like the federal government, your home state offers various types of financial aid. You might be eligible even if you’re not eligible for federal aid. You can find information on state financial aid programs here.

Colleges and universities

Many colleges and universities provide financial aid and scholarships from their own funds, sometimes for a particular field of study. To learn if a school offers this type of financial support, visit the financial aid section of their website or contact their financial aid office directly.

PRO TIP: College financial aid officers are more than willing to help you and your family understand the financial aid process, even before you’ve applied. Don’t hesitate to reach out to them. That's what they're there for.

Now that you know who is available to help you pay for college, it’s important to understand what you can do to make college more affordable.

Start saving

It's never too early to set aside funds to pay for college. There are even specific government-sponsored savings plans to help you do just that. To learn about savings opportunities and strategies, visit the Office of Federal Student Aid and check out their guide to saving early.

PRO TIP: Wondering what a particular college might cost? Get an estimate using the U.S. Department of Education’s net price calculator.

Apply for financial aid

Financial aid comes in many forms from many sources. Start by visiting the Office of Federal Student Aid to learn about the different types of financial aid available (like grants, loans, and work-study). Then, when you're ready to apply, you'll need to complete the FAFSA (Free Application for Federal Student Aid).

PRO TIP: Get a head start on the process by using the Federal Student Aid Estimator. This tool provides an estimate of your eligibility for federal student aid.

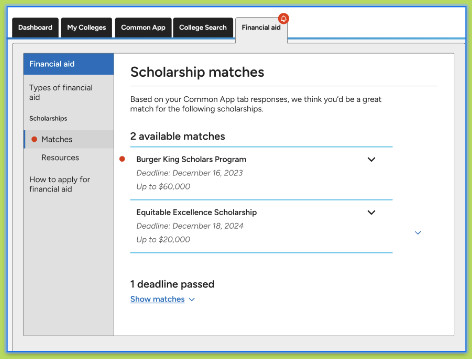

Explore scholarship opportunities

Most scholarships are awarded by individual colleges in recognition of academic performance, athletic excellence, a commitment to community service, or other unique talents. You can learn about these opportunities by visiting individual colleges’ admission and financial aid offices (or websites). You can also find scholarship opportunities through local, regional, and national non-profit organizations.

PRO TIP: Do your research on scholarships! Make sure you talk with the college or university in which you may enroll to understand how their financial aid packages are put together.

- Call the financial aid office at the college or university of your choice before accepting scholarships.

- Ask the college or university of your choice for information about how they treat outside scholarships, and what implications they might have for your total financial aid package.